Non-custodial, Permissionless On-Chain Hedge Fund and Asset Management Protocol

Multi-chain Liquidity Strategy Vaults and Open Market for Asset Managers on Uniswap v3. Access for Quadrat NFT Pass holders only.

Quadrat uses an automated liquidity pool's price range management,

reduces the risk of impermanent losses, rebalances assets and

reinvests earned fees for optimal APY. This approach is superior

to the passive option of providing liquidity. This method ensures

that the pool consistently provides liquidity to the crypto market

by controlling the value and ratio of the respective tokens as

demand grows. In addition, the self-storage of Quadrat LP tokens

that are issued in exchange for liquidity allows you to control

your personal funds fully.

Thus, the risk associated with centralized exchanges, where you

can lose your funds if the exchange is hacked or goes bankrupt, is

completely absent. Quadrat proposes to invest in liquidity pools

passively most efficiently, where the algorithm does all the

active work on-chain.

Automate your liquidity management and passively earn the highest APY

All the funds are directly stored in Uniswap v3 Pools and the asset manager doesn't have access to it

On-chain protocol is managed by Quadrat Governance and can be used by anyone

Strategy LPs could be used as collateral in lending and liquidity farming protocols

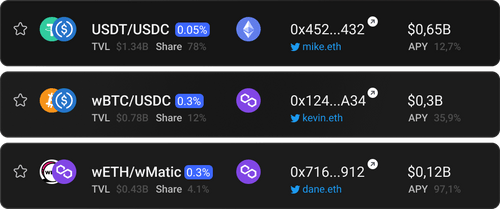

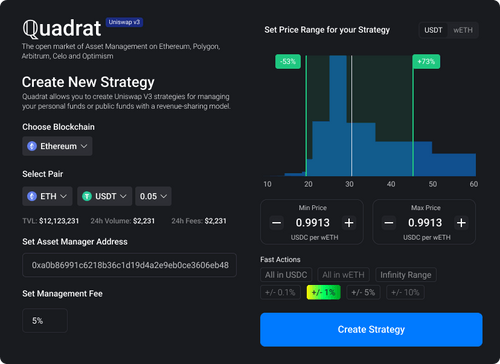

Quadrat is a censorship-resistant and permissionless protocol for DeFi users and liquidity Asset Managers. Quadrat DAO manages vaults with its verified "0xPlasma" Strategies. The creation and management of the strategy is very flexible and powerful. DeFi Fund and Asset Managers can create Uniswap v3 strategies with advanced tools of the Quadrat Protocol.

Backtest:~50% APY

Liquidity is provided evenly within the active price range and follows it through rebalancing, automatic fee collection and reinvestment in the range with protection of impermanent loss.

Backtest:~100% APY

Using an estimated range extraction of implied volatility to provide liquidity, having as parameter protection against impermanent loss.

Backtest:~150% APY

The liquidity position will never expire. The liquidity position will behave like a "perpetual" covered call option. We automate option strategy by rebalancing and setting a stop loss into a more liquid asset.

Backtest:~300% APY

You can provide liquidity to any of the strategies and receive pool tokens in return, which can be used as collateral for obtaining a loan, this method allows you to leverage your share in the pool position and receives a higher income.

One-click and instant Uniswap v3 Rebalancer is optimizing your liquidity management. You can also use Quadrat Protocol to rebalance your own liquidity in Uniswap v3 positions. Quadrat Rebalancer does not use NFT positions and interacts directly with Uniswap v3 smart contracts, which saves you a lot of gas fees.

Create public and private strategy vaults with a whitelist of investors

Track your vault portfolio PnL and APY in real-time

Get access to a rebalancing of your strategies via API service

Get the real-time data of all the vaults and Uniswap v3 pools via our Data Platform and Subgraphs

Quadrat token holders own and govern the protocol. Protocol Perfomance Fee - 2.5%. 1/2 of protocol fees goes to Governance Treasury and 1/2 to 0xPlasma Labs management team

Uniswap Fees

Manager Fees

Protocol Fees

Incentivisation

Quadrat's Decentralized Autonomous Organization will expand the web 3.0 space by unifying the competition between protocols for capital efficiency and governance tools. Governance in the DAO involves creating a competitive environment for the community to develop tools by evaluating and testing the applied strategies to improve the efficiency of capital.

Access to UI, Protocol and Strategies will be able only for Quadrat NFT Pass holders. The total emission of NFT will be 10.000 units.

By Staking $POOL token, you will participate in monthly yield distribution from the protocol and strategies performance.

A token is a key tool for DAO management and decision-making, token holders determine the listing of verified pools and check strategies for effectiveness, as well as tools for rebalancing and changing contract parameters. Quadrat protocol receives a commission from the income of vaults strategies, the income is directed to burning tokens by buying from token exchange pools, thereby providing a market deficit of the token in active trading markets.

$POOL Token will be fair distributed between holders of Quadrat NFT Pass, asset managers and liquidity providers.

Read WhitePaper

Explore Strategies

Join Discord

Copyright © 2077 Plasma Alliance. All rights reserved.

hi@plasma.finance